Indian Indices*

Why Dhanvantree?

We craft personalized plans to maximize your returns. So that, you can grow your wealth effortlessly.

Ditch underperformers, find winning strategies, and invest with confidence, all in one place.

Wide Choices

We offer a wide range of choices for our clients to choose from.

Safe & Secure

We make sure to manage our clients' data with utmost safety and security.

Long-Term Focus

We believe in nurturing assets like a well-tendered tree, ensuring steady growth over the long term.

Client-Centric Approach

We place utmost importance on catering to the needs and ensuring the satisfaction of our clients.

Portfolio Analysis

Worried about your investments? Get a review and stay informed.

Our Services

From roots to riches - Dhanvantree nurtures your financial growth!

Mutual Funds

Small steps, big dreams.

Unlock your financial potential and secure your future through the power of mutual fund investing.

Loans

Don't let money hold you back from what matters. Explore loan options and find the perfect fit for your needs.

Bonds

Enjoy consistent returns with a low-risk approach to growing your wealth, keeping things at ease with peace of mind.

Banking Services

Your gateway to seamless financial management! Get transparent banking solution tailored to your needs.

Fixed Deposits

Secure your future with the stability and growth of fixed deposits avoiding the ups and downs of the market.

Why Choose Our Group?

Running Through the Numbers

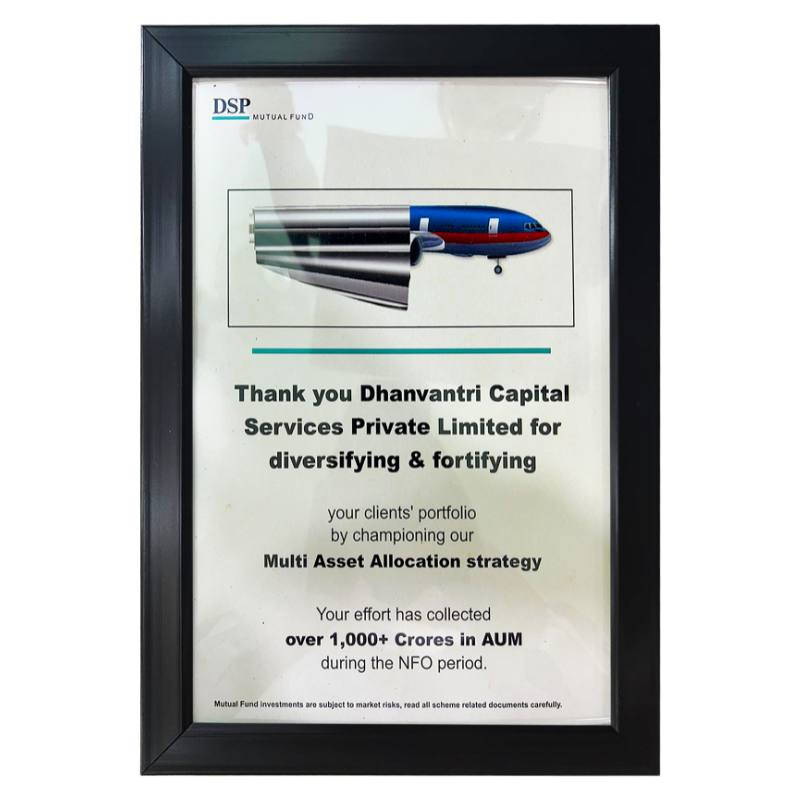

Hall of Fame

Awards Gallery: Dhanvantree's Honors

At Dhanvantreee, we are proud to be acknowledged for our unwavering commitment to excellence in the financial services industry.

Our dedication to providing innovative solutions and personalized support has been consistently recognized by esteemed organizations and industry experts.

Frequently Asked Questions

Here are a few frequently asked questions to solve your doubts regarding investments.

There is no one size that fits all when it comes to investing. but here’s a good starting point:

- Set Goals: Decide what you’re investing for.

- Understand Risk: Know what you’re comfortable with.

- Diversify: Spread your money across different investments.

- Keep Costs Low: Watch out for fees that eat into your profits.

- Stay Informed: Keep an eye on your investments but focus on the long-term.

- Be Patient: Investing takes time. Stick to your plan.

Consider talking to a financial advisor for personalized advice.

Investing suits individuals with clear financial goals, surplus income, and a willingness to wait for long-term returns. Understanding basic principles is crucial. However, it’s not universally beneficial, particularly for those with high-interest debt or immediate financial needs. It’s a decision that requires careful consideration and isn’t suitable for everyone.

Start investing as soon as possible. The earlier your money grows, the bigger it gets thanks to compound interest. Even small amounts add up over time.

To ensure investment safety, make your investment diversified and consider long-term tenure for your investment. Long-term goals give them time to recover. Research before you invest, and consider an advisor for a personalized plan.

Asset allocation refers to how you divide your investment portfolio among different asset classes, like stocks, bonds, and cash. Investing in different things to minimize risk and reach your goals.

Here are a few frequently asked questions to solve your doubts regarding investments.

There is no one size that fits all when it comes to investing. but here’s a good starting point:

- Set Goals: Decide what you’re investing for.

- Understand Risk: Know what you’re comfortable with.

- Diversify: Spread your money across different investments.

- Keep Costs Low: Watch out for fees that eat into your profits.

- Stay Informed: Keep an eye on your investments but focus on the long-term.

- Be Patient: Investing takes time. Stick to your plan.

Consider talking to a financial advisor for personalized advice.

Investing suits individuals with clear financial goals, surplus income, and a willingness to wait for long-term returns. Understanding basic principles is crucial. However, it’s not universally beneficial, particularly for those with high-interest debt or immediate financial needs. It’s a decision that requires careful consideration and isn’t suitable for everyone.

Start investing as soon as possible. The earlier your money grows, the bigger it gets thanks to compound interest. Even small amounts add up over time.

To ensure investment safety, make your investment diversified and consider long-term tenure for your investment. Long-term goals give them time to recover. Research before you invest, and consider an advisor for a personalized plan.

Asset allocation refers to how you divide your investment portfolio among different asset classes, like stocks, bonds, and cash. Investing in different things to minimize risk and reach your goals.

Find out more about Dhanvantree

Navigate the currents of finance confidently with Dhanvantree as your compass.

Meet the Team

Discover the passionate & skilled individuals driving Dhanvantree's success, each bringing unique expertise & a shared commitment to your financial well-being.

Join our Team

Join our network of driven agents and become an integral part of Dhanvantree's mission to empower clients with exceptional financial services and opportunities.

Contact Us

Got questions or need assistance? Reach out to our team today for expert financial guidance and personalized support tailored to your needs.

Meet the Team

Discover the passionate & skilled individuals driving Dhanvantree's success.

Join our Team

Join our network of driven agents to empower clients with exceptional financial services and opportunities.

Contact Us

Got questions or need assistance? Reach out to our team today for financial guidance.

Empower Through Knowledge

Risk Assessment Tool

Don't let uncertainty hold you back from achieving your financial goals. Take the first step towards financial security by accessing our Risk Assessment Tool today.

Praise from our Clients, Associates and Business Partners

Hear their Success Stories!

Our Business Partners

Check the latest KYC status.

| KYC Portal | Links for Aadhar Validation |

|---|---|

| Camskra | https://camskra.com/PanDetailsUpdate.aspx |

| CVLKRA | https://validate.cvlindia.com/CVLKRAVerification_V1/ |

| KARVYKRA | https://www.karvykra.com/KYC_Validation/Default.aspx |

| NDMLKRA | https://kra.ndml.in/ClientInitiatedKYC-webApp/#/ClientinitiatedKYC |

| KYC Portal | Links for Mobile Number / Email Address Validation |

|---|---|

| Camskra | https://camskra.com/PanDetailsUpdate.aspx |

| CVLKRA | https://validate.cvlindia.com/CVLKRAVerification_V1/ |

| KARVYKRA | https://mfs.kfintech.com/Investor/General/ValidateKYC |

| NDMLKRA | https://kra.ndml.in/ClientInitiatedKYC-webApp/#/ClientinitiatedKYC |